Wednesday, August 12, 2020

Wednesday, August 5, 2020

UNPARALLELED EXPERIENCE

Champlain

Business College

Burlington

VT

Accounting

|

Quality

Control Inspector

NASA

Apollo Lunar Lander Module

Simmonds

Precision

Vergennes

VT

|

Castleton

State College

BA

Sociology

Castleton

VT

|

Amoco

Gas & Store owned Operated during

Castleton yrs.

|

Substitute Teacher Citrus County

CR High School &

others

|

Liberty

Delivery

Homosassa

FL 18 years

|

Citrus

County Property Appraiser

Field Appraiser Retired 2017 14 years

|

David Gregory Republican Candidate for Property Appraiser

Graduating from Castleton University of Vermont in 1977, with a Bachelor of Arts Degree in Sociology and a minor in Education, I owned and operated an Amoco gas station and general store while I attended college and with an apartment over the store in Whiting VT, it was a perfect fit. Coming down to Citrus County Florida for a winter break I met my future wife, Corl, plans changed and I bought a home in 1978 and have been living in Citrus ever since. My father, Bernard Gregory, a retired Army Sergeant with 22 years in the military, having jumped with the 101st on D Day into Normandy, came to Citrus with my mother, Rita, after I had made Citrus our home. There are now 5 generations of our family who call Citrus home.

I have the unique experience of having worked with 4 different Property Appraiser Administrations with the Property Appraiser office. Starting with Ron Schlutz, Melanie Hensley, Geoffrey Greene and Les Cook, I’ve seen what works and what hasn’t over the 14 years with the office. It is my aim to put the best aspects of each administration into play and by keeping an open door policy with the public addressing their concerns when they should arise.

Before the years at the property appraiser office I ran my own business, Liberty Delivery, with 20 to 30 employees depending on the time of the year. We serviced all of Citrus County and had a contract with Citrus County that was renewed every year for 18 years! That was and is something unheard of today.

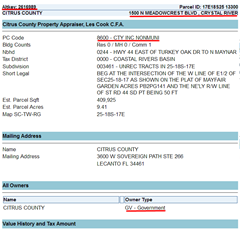

As I said to the Citrus County Building Alliance, being the only candidate that has been cross trained in all fields of the Property Appraiser office I offer the complete package for the future of the builders and others who will need that expertise as we transcend these difficult times that lay ahead. I was talking with my barber yesterday she bought a home in Walden Woods and I explained to her about having to buy the yearly stickers for the home, much like getting your vehicle registration renewed each year and because you do not own the land your home is on the land belonging to Walden Woods LLC and even with an amended Tangible Exemption of $25,000 that still left a Tangible tax bill for the owners of the park property of over $107,000 in 2019, subsequently the owners of the homes in the park and those who may be renting homes in the park will see a bill for their share in some form or manner.

Most of you have met people from different areas of business that can do the talk but can’t do the walk, I certainly have, in fact I’ve hired some during the years and having discovered their talk was the only thing they were good at! This is something you certainly don’t want in the property appraiser office. Not only can I do the talk I can do the walk because of being cross trained in all departments of the property appraiser’s office I know where potential problems may arise before they ever appear. Part two coming soon: CITRUS SLUSH

ARTICLE FROM EYEONCITRUS.COM

IT’S CALLED A “SLUSH FUND”

Mr. Gregory said,

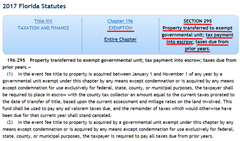

“If I had been appraiser when Les Cook wanted to go to Tyler

Technologies for the Citrus County Property Appraiser’s office online

presence I would have gone online to see what kind of reputation the

company had. Well, I wasn’t the Property Appraiser and he didn’t, but as

one of the employees who would be working with the new system I thought

it important to investigate for myself what the new system would have

in store for us.” And this is what he discovered: Nassau County, New

York had been using Tyler Technologies for 5 years and had all kinds of

problems with them, not the least of which, was the fact the company’s

system had been taxing the buildings of county government for property

taxes! Nassau County is located immediately east of New York City. The

county, together with Suffolk County to its immediate east, are

generally referred to as “Long Island”. Two cities, three towns, 64

incorporated villages, and more than 60 unincorporated hamlets are

located within the county. At the time Mr. Gregory did his investigation

into Tyler Technologies, he said “this information was readily

available, over the ensuing years Tyler Technologies has worked out it

problems with Nassau County, New York and now has a 20 to 30 million

dollar contract with the county for it’s online presence.”

Before the Complex was bought the Citrus County Board of County Commissioners and the

Share if you want a better Citrus!

Have questions? Contact me BY replying to this email, if you want to

Questions asked on the Donation form are required per FL statute.

Contribute to the campaign either through the donorbox application (100% secure) below

or mail a donation to: